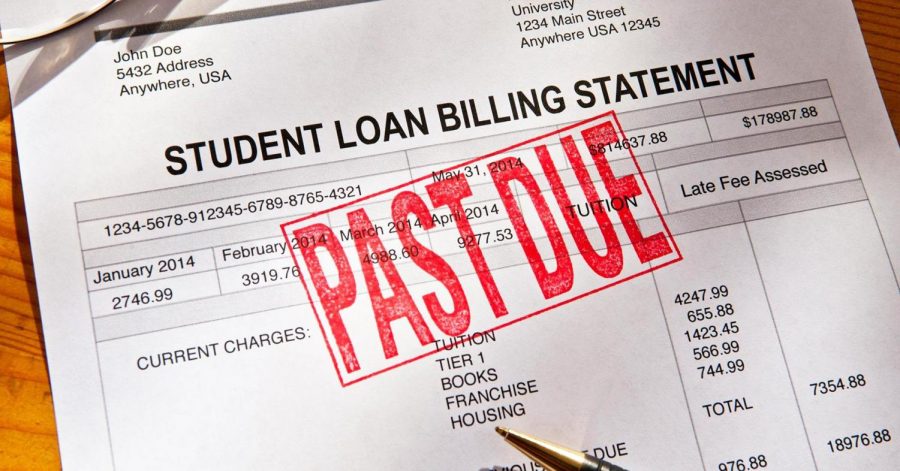

Student debt is constantly increasing issue, follows students for lifetime

March 29, 2018

As the end of the year approaches, seniors and juniors are looking at their futures after high school. While many students plan to attend college, how are they are planning to pay for the amount of student debt that many are bound to have throughout their college experience?

Some students don’t think about potential debt before they apply to colleges and instead tend to worry about making sure that they have the grades in order to get into their school of choice. Tuition cost and student debt, however, can stop many students from finishing college.

According to blog.classesandcareers.com, 50 percent of students who drop out of college have an income under $35,000 per year. These students can not provide enough money to keep them themselves in a good financial standing while also paying their tuition. Students can get loans to help them with their tuition cost. These loans will soon pile up, however, leaving students to pay loans for the rest of their lives.

Tuition costs and student loans are directly related. As tuition costs are raised, the amount of student loans that are owed to federal government or a private sector. While federal loans are better for students, not all students qualify for a federal loan. If a student doesn’t quality for a federal student loan, they have to choose a private student loan, which is based solely on the basis of credit history. I believe that an alternative to student loans needs be placed in set for students.

Tuition is constantly increasing in part due to inflation, and tuition cost is increasing faster than finical aid services, which leaves many students in a losing battle. These increases are not slowing down. According to the US Department of Education, the average cost of college tuition during the 2015-2016 school year for a four-year private school was $25,725, and if the current growth rates continue, by the 2034-2035 school year, the average cost for a four-year private school would be $83,640. That is a huge difference. Students are currently struggling to keep up with their student loans, so how is the younger generation going to keep up with the elevated costs the would have to pay?

Some students rely on financial aid and loans to get them through college, but then, their debt follows them all throughout their lives. The standard payment plan for federal student loans expects students to pay off their debt in about ten years, but for many students, this is not the case. According to federalreserve.gov, there are 6.8 million student loan borrowers that are between the age of 40 and 49.

While there isn’t an immediate solution to student loans, I believe the United States needs to invest more time in making sure that there is enough financial aid and other resources to help students keep up with their student debts. While some colleges around the country are increasing their financial aid budget, their budget cannot compete with the tuition rates.